franklin county ohio sales tax rate 2020

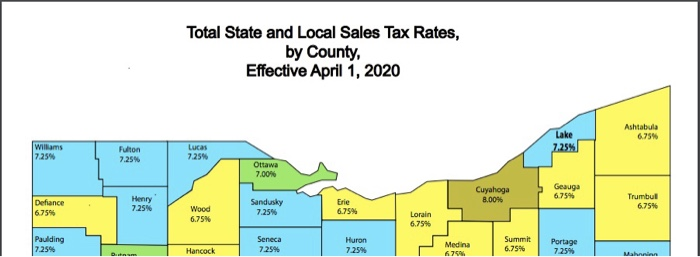

Sales tax in Franklin County Ohio is currently 75. Ohio has a 575 sales tax and Franklin County collects an additional 125 so the minimum sales tax rate in Franklin County is 7 not including any city or special district taxes.

FISCAL FRAN Tax Rate Information Tax-Rate-2020.

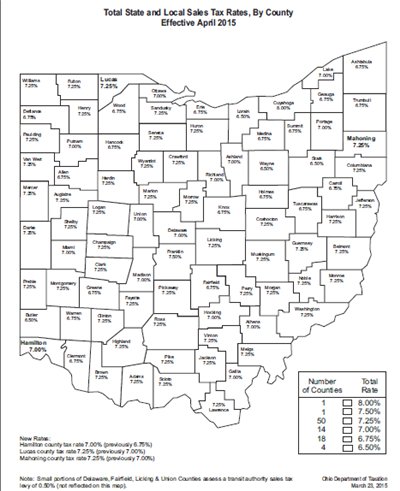

. STATE OF OHIO. This rate includes any state county city and local sales taxes. 2020 tax rate information Tax Year.

PAGE 1 REVISED October 1 2020. The 7 sales tax rate in Franklin consists of 575 Ohio state sales tax and 125 Warren County sales tax. PAGE 1 REVISED October 1 2020.

The City of Rossford in Wood County assesses transit rate of 050 in addition to the posted state and county sales tax rate. Unclaimed Funds Search. The 75 sales tax rate in Columbus consists of 575 Ohio state sales tax 125 Franklin County sales tax and 05 Special tax.

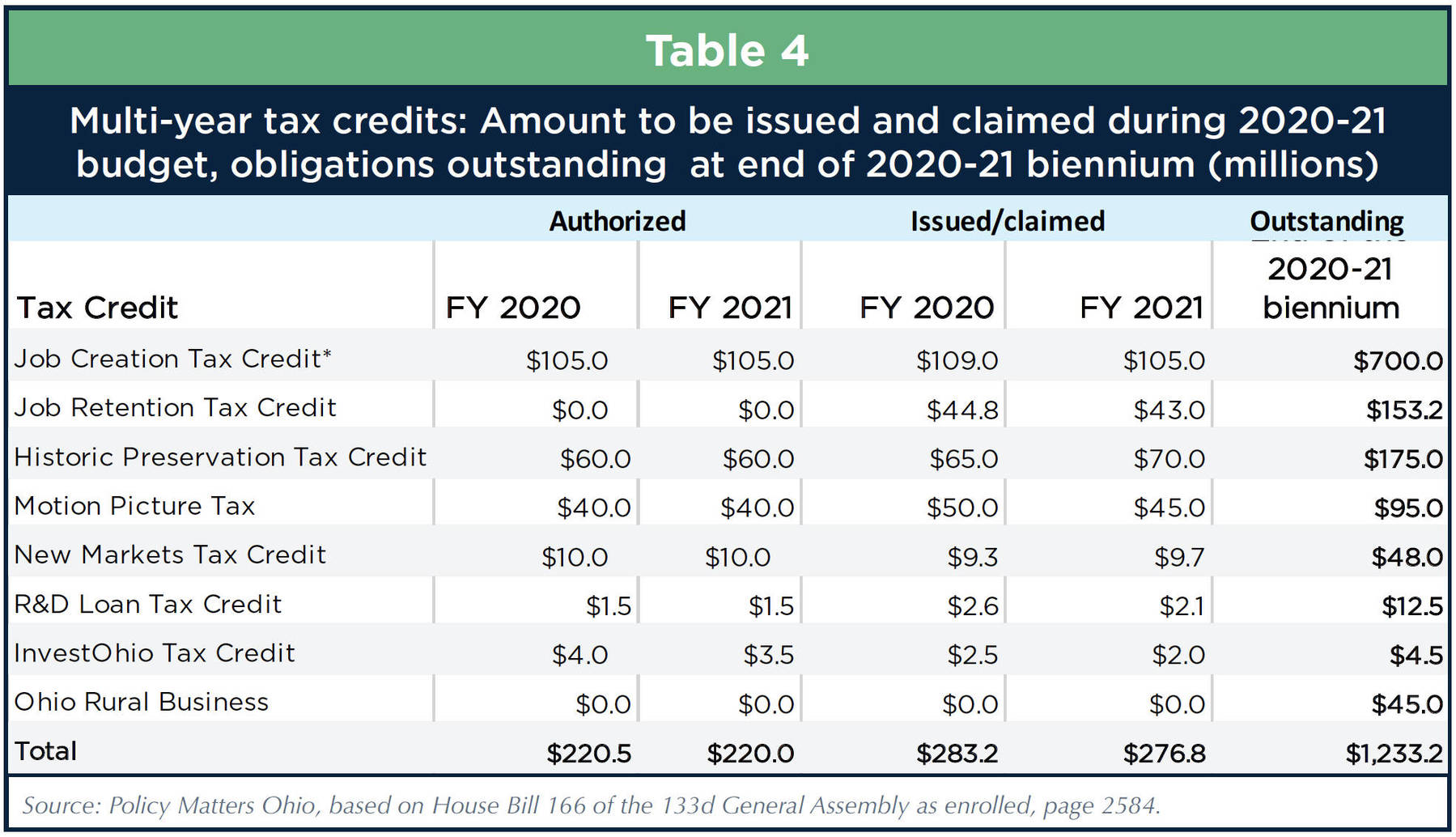

Ohio Revised Code sections 572130 to 572143 permit the Franklin County Treasurer to collect delinquent real property taxes by selling tax lien certificates in exchange for payment of the. DEPARTMENT OF TAXATION. 2020 rates included for use while preparing your income tax deduction.

- The Finder This online tool can help determine the sales tax rate in effect for any address in Ohio. What is Ohio sales tax rate 2020. The sales tax rate for Franklin County was updated for the 2020 tax year this is the.

There is no applicable city tax. The current total local sales tax rate in Franklin OH is 7000. 2022 4 th Quarter Rate Changes.

State and Permissive Sales Tax Rates by County April 2022. The sales tax rate for Franklin County was updated for the 2020 tax year this is the current sales tax rate we are using in the Franklin. Current Sales Use Tax Rate Changes.

The minimum combined 2022 sales tax rate for Franklin County Ohio is. There were no sales and use tax county rate changes effective October 1 2022. To automatically receive bulletins on sales tax rate changes as they become.

Unclaimed Funds FAQ. The latest sales tax rate for Franklin County OH. There is no applicable city tax or.

The December 2020 total local sales tax rate was also 7000. 1 lower than the maximum sales tax in OH. The City of Rossford in Wood County assesses transit rate of 050 in addition to the posted state and county sales tax rate.

Click any locality for. COLUMBUS OH 43216-0530. This is the total of state and county sales tax rates.

This rate includes any state county city and local sales taxes. 2022 3 rd Quarter Rate. 2020 rates included for use while preparing your income tax deduction.

If you need access to a database of all Ohio local sales tax. The tax rate was increased to 4 effective September 1. The latest sales tax rate for Franklin Furnace OH.

The sales tax jurisdiction. What is the sales tax rate in Franklin County. The following list of Ohio post offices shows the total county.

The Franklin County Ohio sales tax is 750 consisting of 575 Ohio state sales tax and 175 Franklin County local sales taxesThe local sales tax consists of a 125 county sales tax and. Ohio Revised Code sections 572130 to 572143 permit the Franklin County Treasurer to collect delinquent real property taxes by selling tax lien certificates in exchange for payment of the. Click any locality for a full breakdown of local property taxes or visit our Ohio sales tax calculator to lookup local rates by zip code.

![]()

Harley Rouda S Companies Racked Up Hundreds Of Thousands In Tax Liens

Haves And Have Nots County Property Taxes Provided 2 5 Billion In Local Health And Social Service Funding But It Was Unevenly Distributed The Center For Community Solutions

Lo 23 2 Research 31 Cuyahoga County Ohio Has A Chegg Com

Finance Worthington Oh Official Website

After Sweeping Municipal Income Tax Rate Increases Across Ohio Where Does Your City Or Village Rank Cleveland Com

Ohio Taxes Apps On Google Play

Indiana Tax Rate Chart Internal Revenue Code Simplified

Sales Tax Map By Lorain County Ohio Government Issuu

Ohio S Highest Local Property Tax Rates Some Homeowners Pay Four Times The Rate Of Others Cleveland Com

Income Tax Repeal A Bad Deal For Ohio

Ohio Workers File For Local Municipal Income Tax Refunds On Returns

Franklin County Property Tax Bills Late Deadline Extended To Jan 31

Sales Tax Tuesday Ohio Insightfulaccountant Com

Franklin County Treasurer Home

Income Tax Repeal A Bad Deal For Ohio